Help to Buy London

Help to Buy 2021 – everything you need to know about the scheme and how you can buy a home with Help to Buy in London.

Get yourself on the ladder and into your dream home with Help to Buy London.

Applying for Help to Buy can be complicated, but here at mypropertyadvice.com we are here to help you through the process and realise the ambition of being a homeowner. Our advisors are on hand to guide you through the process step-by-step so you get your ideal home, easily and stress free.

An Introduction

Applications for the new 2021 scheme are now open. There have also been some subtle changes to the previous Help to Buy equity loan scheme that it is worth noting.

The new Help to Buy 2021 scheme is now only available for first-time buyers. Previously the scheme allowed all purchasers buying a new-build to buy using the scheme, however the government has decided to restrict the current version to those who do not yet own a property.

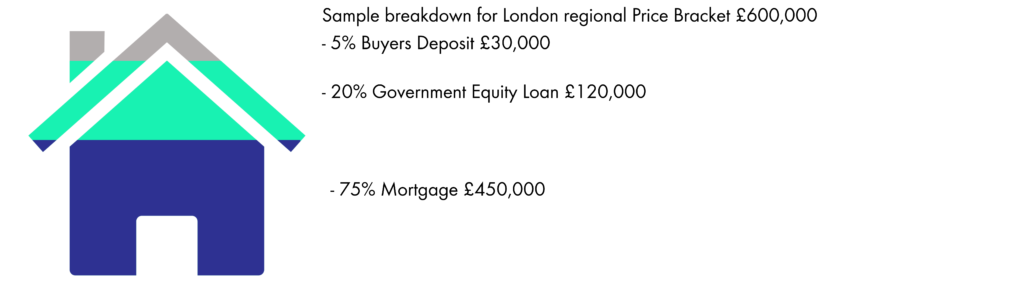

Another change is the new regional price limits where buyers will only be able to use the scheme up to a set price depending on where they are buying. As this guide focuses on London, you can purchase using Help to Buy up to a value of £600,000.

Help to Buy in London

The London property market is one of the most stable in the world, attracting strong demand from local Londoners and global investors alike. It can be a competitive market to buy a home, especially if you are a first-time buyer with a small deposit.

The Help to Buy equity loan scheme has enabled thousands of Londoners to get on to the property ladder and with the regional price cap of £600,000, homeowners have a decent budget to find a property. This scheme puts one of the greatest cities in the world within reach for many more young people.

More than the country’s capital, London is a global capital of incredible arts, music and culture. It is a unique melting pot of cultures where you can feel like you travelled across the world by simply going from one neighbourhood to another. Help to Buy creates a fantastic opportunity to get on the ladder in one of the most desirable places in the world.

Remember, the Help to Buy equity loan is still income assessed and so not everyone will be able to buy using the full £600,000 limit. However, for more information on how much you could borrow, feel free to speak to one of our experts.

What does the £600,000 London price cap mean?

The new Help to Buy scheme for 2021 sees the introduction of regional price limits, with buyers not able to use the scheme to purchase a home costing more than 1.5 times the average first-time buyer property price in the area they are buying. This equates to £600,000 for London.

What can you buy for £600,000 in London?

For first-time buyers, the average price paid for a property in London is £462,617, so the £600,000 should be generous enough for most people looking to utilise the scheme.

Most first-time buyers in London look for either a one- or two-bedroom apartment. Depending on where you want to live, the London price cap of £600,000 should allow you to achieve the starter home you desire.

Anecdotally, it is becoming very hard to find a new build property that qualifies for Help to Buy in Zone 1. However, the further from the city centre you go, the more choice you begin to get.

Where do I find a Help to Buy eligible home in London?

Remember, not all housebuilders qualify to sell through the Help to Buy scheme and finding out which ones do can be mind boggling. Not all are listed through the government websites and there is clearly a lack of information on the subject.

At mypropertyadvice.com we navigate through the Help to Buy market to provide you with impartial advice on the best properties available to you in your area. For a free call for some initial advice, contact us below.